Cuba’s Central Bank (BCC) has announced new measures to increase the use of electronic channels for payment transactions “between all actors of the economy and the population”. The move comes amid an acute shortage of cash at ATMs and a desire to curb black market transactions and tax evasion. “We are accelerating a process that meets international standards, electronic payments are part of the everyday life of citizens in every country,” BCC Vice President Alberto Quiñones Betancourt said at a press conference on wednesday.

As announced by the Central Bank, ATMs shall in the future be used mainly by the population to withdraw salaries and pensions, rather than to provide larger sums for business transactions. Private businesses and the self-employed can “request the cash necessary for their activities at the bank branches where they maintain their checking or tax accounts, under the conditions agreed with the bank and in accordance with the operational and tax conditions.” However, small amounts up to 5,000 pesos (US$ 40) per day can still be obtained from businesses owners accounts via ATM.

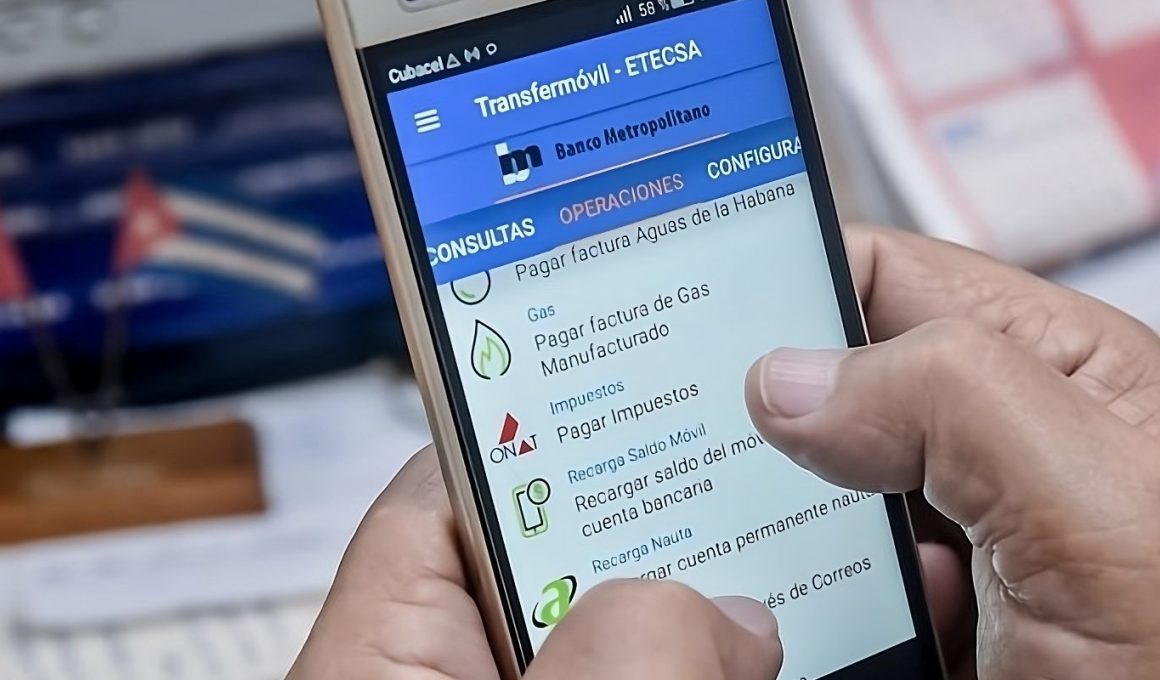

The commercial transactions between all economic agents will be carried out “using credit instruments and other applicable means of payment other than cash, giving priority to electronic means and channels whenever possible, and crediting current or tax accounts”, the bank announced. It also seeks to create conditions to gradually use electronic payment apps such as “EnZona” and “Transfermóvil” (which already have over four million users) in all economic entities, including the private sector. To incentivize the switch, a discount of at least two and up to 10 percent is currently offered for app payments, which is reimbursed by banks.

Despite improvements in electronic payment options, cash transactions in Cuba have increased “due to inflation and other factors” in recent years, the bank’s statement said. At the same time, the ATM network suffers from a shortage of spare parts. In recent weeks, there have been increasing reports from various parts of the country whose ATMs were barely stocked, with large bills in particular becoming increasingly scarce. The first signs of problems began to emerge in April, when new banknotes with reduced security features were issued. According to the latest data from the Ministry of Economy, inflation was 45 percent this year, and since the start of the currency reform on Jan. 1, 2021, economists estimate that prices have risen by more than 500 percent.

On Monday, the Cuban Council of Ministers decided to quickly implement a program to “bankarize” payment flows. Such a step had been contemplated for some time with a view to combating corruption, money laundering and tax evasion, but has been repeatedly thwarted with the emergence of exchange rate duality since the currency reform. However, the inadequate digital payment infrastructure has also played its part in Cuba being a largely cash-only domain to date. With the increasing spread of the Internet and payment apps, which are already widely used for incidental expenses and purchases of rationed goods at bodega-stores, the government now seems to feel ready to step up pace: As a first step, it was announced that the state-run network of approximately 1,000 gas stations will stop accepting cash payments by Oct. 31. This month will also see the start of a pilot program in which the state electricity provider UNE will switch completely to cashless payment in several districts of Havana. Together with the latest measures, the government is likely to want to kill two birds with one strike: improve the availability of cash for private individuals again on the one hand and, at the same time, gain more control over payment flows in the private sector. The meassure is likely to be part of a bigger “macroeconomic stabilization program”, announced by economic minister Alejandro Gil at the last parliamentary session in July and whose implementation is sheduled for the second half of the year and the first half of 2024.

How the meassures will be implemented remains to be seen: The payment infrastructure is still poorly developed in many places, and apps and card payments can only be used in the state sector so far – while most private businesses rely on black market exchanges to make their purchases in foreign currency due to the banks’ lack of foreign currency (the 120 exchange rate introduced in August 2022 still can’t be served due to a lack of hard currency). The measures can also be interpreted as a strike towards the informal exchange market, whose rate recently reached 230 pesos per dollar, a new all-time high since the 1990s.

In the medium term, the digitization strategy could tighten the supply of pesos in circulation and thereby shift a larger share of foreign exchange transactions back into the banking circuit, which would benefit the stability and operability of the official exchange rate. The ongoing devaluation of the peso in state-owned enterprises and Joint-Ventures, which are increasingly operating at the 120 exchange rate instead of 24:1, should also contribute to this. However, the changeover is likely to be anything but straightforward.

The measures are to be implemented “gradually” from August 3, and have been published in “Resolución 111/2023” (PDF) of the Law Gazette. The legislation specifies that the bankarization must be implemented for all forms of ownership within six months of the law’s entry into force (that is, no later than February 2024). “After the ‘currency reorganization’ of 2021, we are now sorting ourselves out after all,” Cuban economist Juan Triana of the Center for the Study of the Cuban Economy (CEEC) commented.

This article was first published on Cuba Heute, a German-language news portal.